Report 6009 : TL/IRS Hedging Analysis (W5)

This version is superseded. Click here to view the latest guide.

PURPOSE

To provide the details used by CS Lucas to show TL/IRS Hedging Analysis.

WHY IS THIS IMPORTANT?

Allow users to verify the details of TL/IRS Hedging Analysis.

QUERY

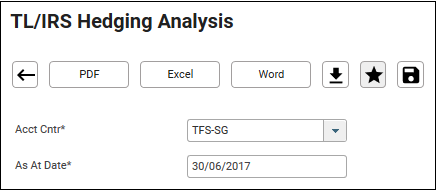

1. Navigate to Reporting > Standard > Report 6009: TL/IRS Hedging Analysis.

2. Fill in the mandatory parameter – Accounting Centre/ Group, As At Date.

3. Click on the required format.

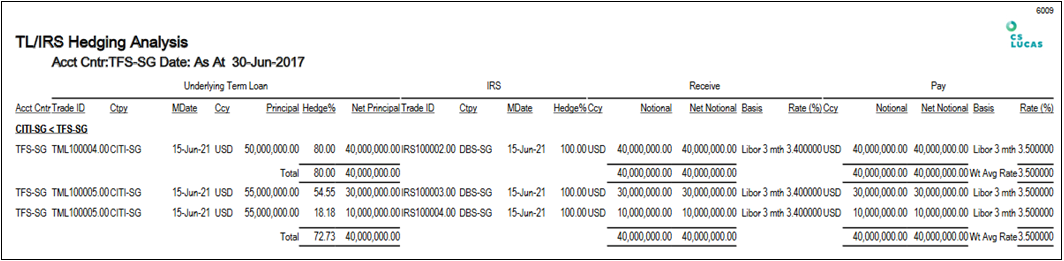

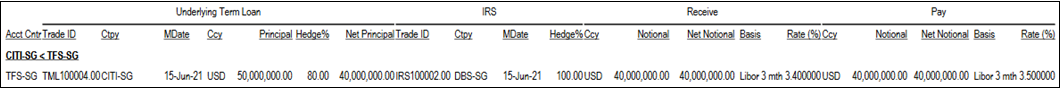

4. The report shows the Accounting Centre, underlying Term Loan (Trade ID, Counterparty, MDate, Currency, Principal, Hedge%, Net Principal, IRS (Trade ID, Counterparty, MDate, Hedge%, IRS Receive Leg (Currency, Notional, Net Notional, Basis Rate, Rate (%), IRS Pay Leg (Currency, Notional, Net Notional, Basis, Rate (%)).

For explanation of ![]() button, please see link.

button, please see link.

For explanation of ![]() buttons, please see link.

buttons, please see link.

DATA SOURCE

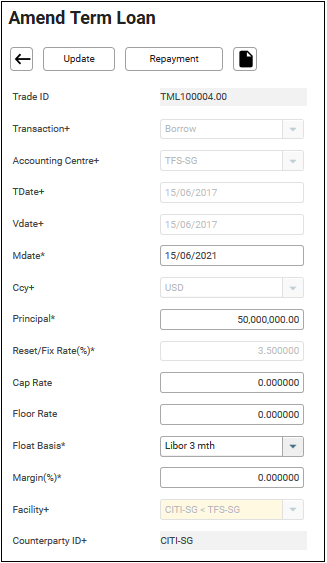

I) To view the following Term Loan transaction,

Follow the steps as shown below:

1. Navigate to Transaction > Term Loan.

2. Select Acct Cntr* (From example: TFS-SG).

3. Key in MDate Fr* (From example: 1-Jun-2017).

4. Click Refresh.

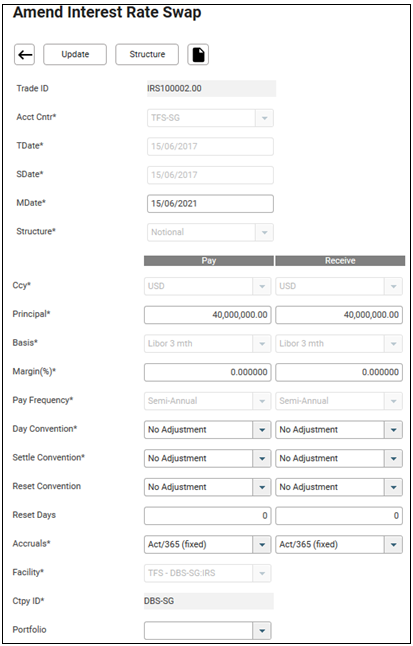

II) To view the IRS transaction,

1. Navigate to Transaction > Interest Rate Swap.

2. Select Acct Cntr* (From example: TFS-SG).

3. Key in MDate Fr* (From example: 1-Jun-2017).

4. Click Refresh.

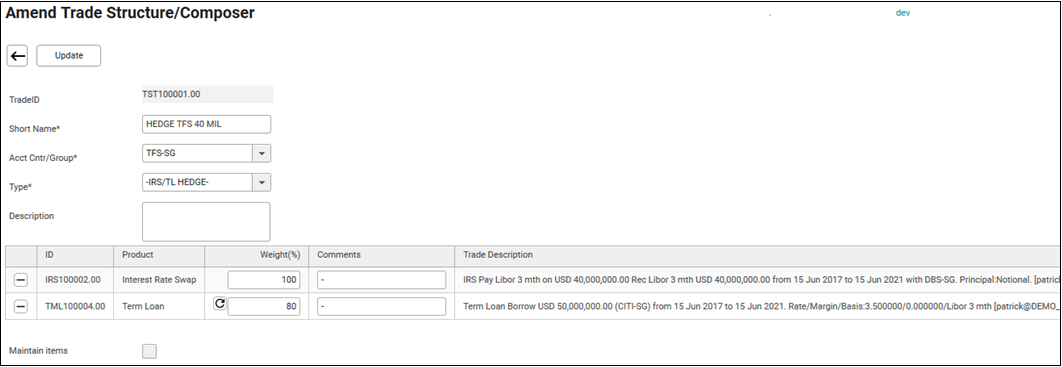

III) To view hedged information for TML100004.00 and IRS100002.00,

1. Navigate to Transaction > Structured Deals.

2. Click Refresh.

3. Click to drill down on the Trade Structure.

4. In this trade structure group, 80% of TML100004.00 (USD 50 MIL) is hedged to 100% of IRS100002.00 (USD 40 MIL). Hence, 40,000,000 is shown under Net Principal and Hedge% is 80 in the report.

FREQUENTLY ASKED QUESTIONS

RELATED INFORMATION

General Formatting For All Reports

CHANGE HISTORY