Computation of Purchase Interest for Bonds (W5)

This version is superseded. Click here to view the latest guide.

PURPOSE

This document describes the procedure for the computation of purchase interest for Bonds.

WHY IS THIS IMPORTANT?

This allows users to verify the formula and methodology used by CS Lucas to compute the purchase interest for a bond.

FORMULA

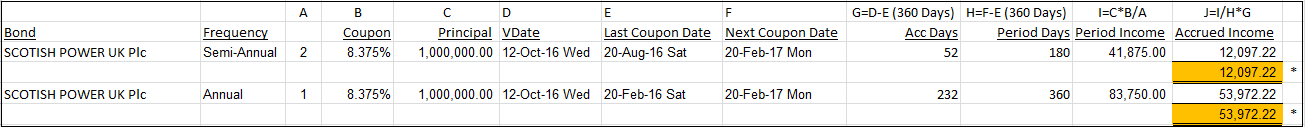

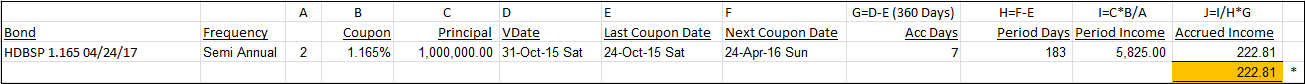

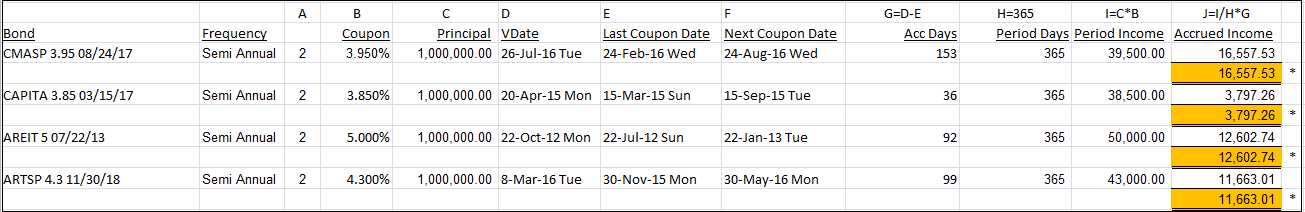

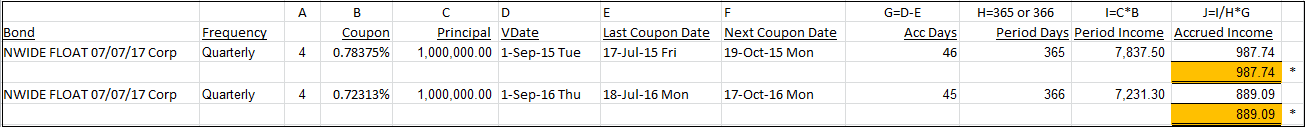

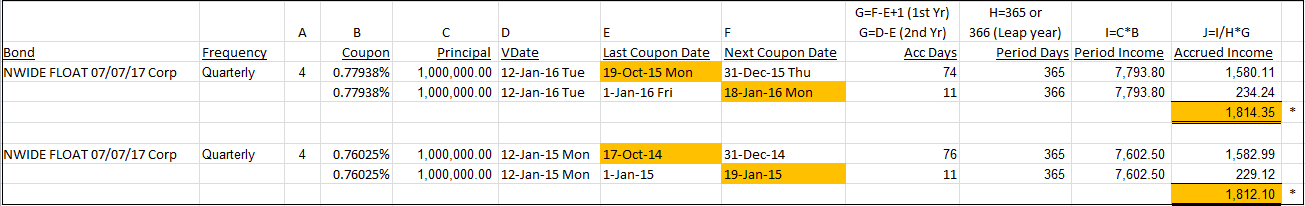

The following examples show different types of bond purchase interest methods and how system computes the purchase interest.

Note: Computation of purchase interest is based on the last coupon date till the transaction’s value date.

PI-Act/Act

PI-30/360

PI-30/Act

PI-Act/365

PI-Act/365 (Act)

Case 1 – Start and end in the same year

Case 2 – Start and end in different years

[Blank]

If no PI computation method is selected, system computes the purchase interest based on the formula below:

Principal * Coupon% * Currency accrual method

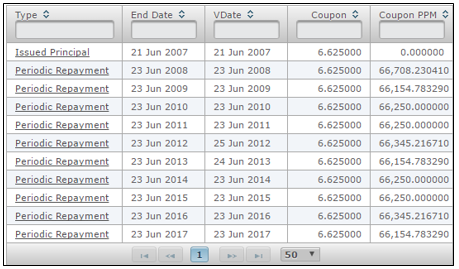

Let’s say the coupon schedule is as per below and bond transaction’s VDate is 28 Apr 2016.

Last coupon payment date = 23 Jun 2015

Next coupon payment date = 23 Jun 2016

Bond transaction’s VDate = 28 Apr 2016

Please see below computation of purchase interest based on different currency accrual methods.

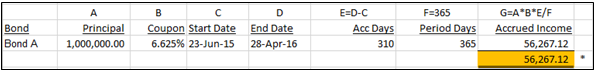

(i) Currency accrual method = Act/365 (fixed)

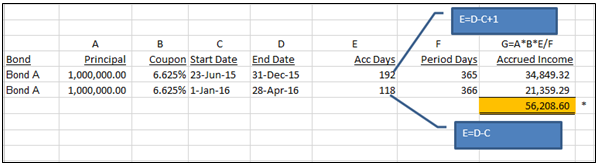

(ii) Currency accrual method = Act/365 (Act)

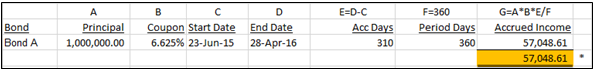

(iii) Currency accrual method = Act/360

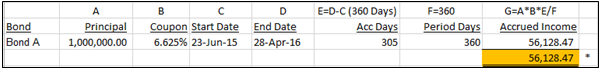

(iv) Currency accrual method = 30/360

* The accrued income is rounded to currency decimal places. Currency decimal places is determined at the currency set up. See Set Up Currency.

RELATED INFORMATION

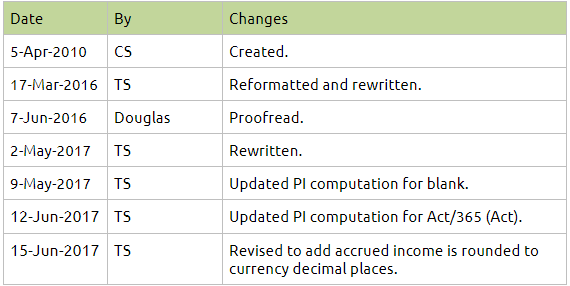

CHANGE HISTORY